Only after the birth of a girl child in the house, do the parents start worrying about her education and marriage. In such a situation, many parents start saving some part of their savings at the same time, so that when the daughter grows up. At that time those savings money can be used for his higher education or studies. Significantly, these people prefer to invest their savings in safe savings schemes or fixed deposit schemes. In this connection, today we are going to tell you about a wonderful government scheme, which is specially designed to secure the future of daughters. The name of this scheme is Sukanya Samriddhi Yojana. This scheme was started in the year 2015. Many people in the country are investing in this scheme by opening their daughters' accounts. Let's know about it in detail -

Sukanya Samriddhi Yojana is a small savings scheme. You can invest in this scheme keeping the long term in mind. At present, you are getting an interest rate of 8 percent on investing in Sukanya Samriddhi Yojana.

The special thing about this scheme is that in this you can open an account with just Rs 250. The maturity period of this scheme is for 21 years. However, the parents have to invest in the name of the daughter for a total of 15 years. At the same time, for 6 years, the daughter's account remains operational without investment in Sukanya Samriddhi Yojana.

The maturity period of this scheme is for 21 years. However, after the girl child turns 18, you can withdraw up to 50 percent of the deposit from this scheme for her education.

On opening an account in Sukanya Samriddhi Yojana, you also get tax exemption under section 80C of Income Tax. If you want to invest in a good scheme for your daughter. In such a situation, Sukanya Samriddhi Yojana can prove to be a better option for you.

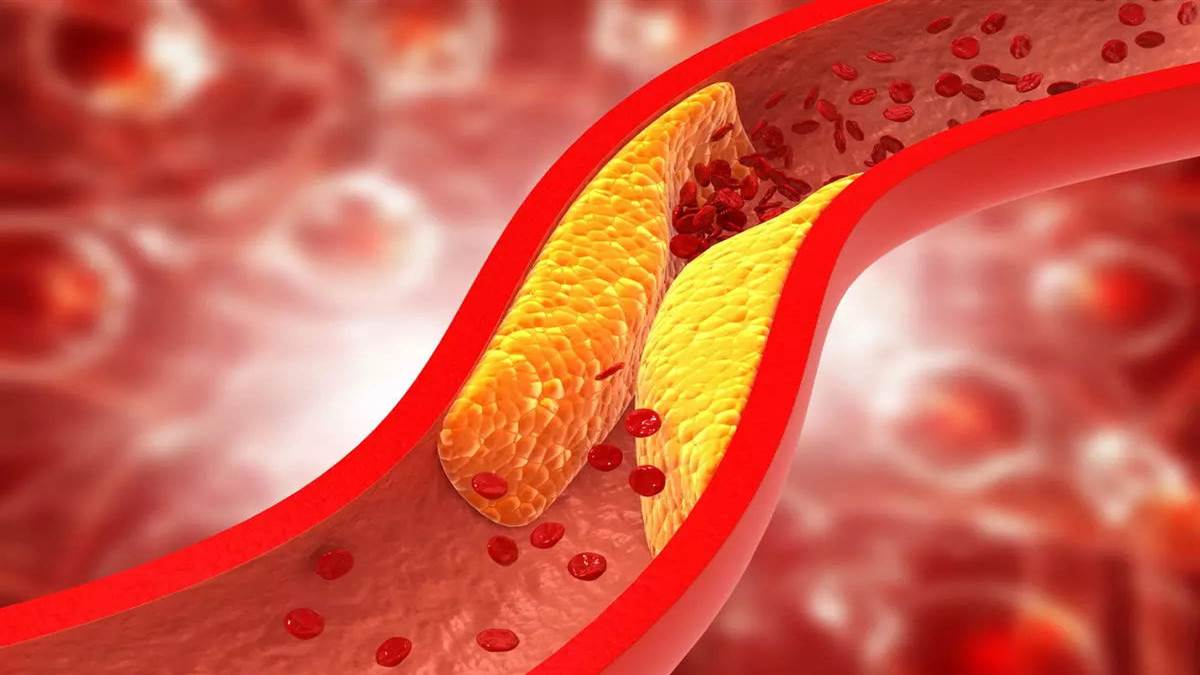

(PC: iStock)