At present, a bank account is very important. To ensure that everyone has a bank account, the central government led by Narendra Modi started the Pradhan Mantri Jan Dhan Yojana (PMJDY).

The Jan Dhan Yojana was started on 28 August 2014. In this scheme, beneficiaries can easily open a zero-balance account. According to the official website of the Jan Dhan Yojana, currently, there are 52.39 crore beneficiaries of the Jan Dhan Yojana. This means that there are 52.39 crore Jan Dhan accounts.

There is a slight difference between a Jan Dhan account and a normal bank savings account. Jan Dhan accounts provide more benefits than savings accounts.

Benefits of Jan Dhan Savings Account

Interest is paid on the amount deposited in the Jan Dhan Savings Account.

Jan Dhan Yojana also provides accident insurance of Rs 1 lakh and life cover of Rs 30,000.

There is no limit to keeping a minimum balance in Jan Dhan's account.

In Jan Dhan Yojana, the beneficiary gets the facility of an overdraft of Rs 10,000.

After opening the Jan Dhan account, the beneficiary gets a Rupay ATM Card.

How to open Jan Dhan Account

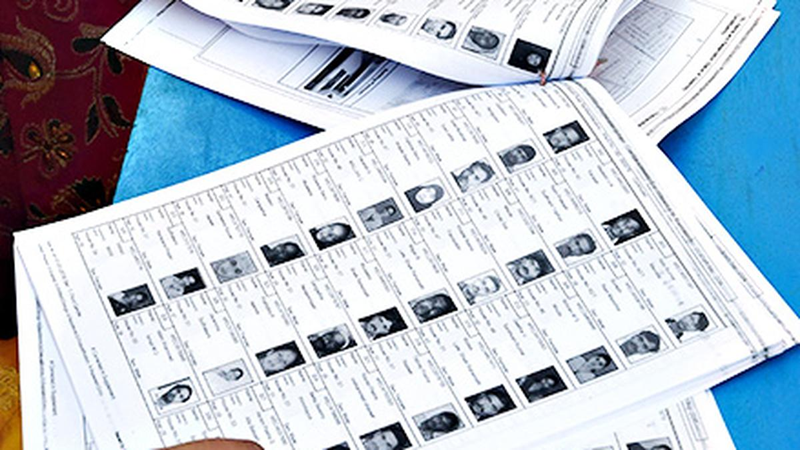

If you want to open a Jan Dhan account, you can go to the post office or bank and get the account opened. An Aadhaar Card and PAN Card are mandatory for opening an account.

The age of the applicant should be at least 10 years to open an account. Bank account holders can also change their savings account to a Jan Dhan account.

How to open Jan Dhan Account Online

You go to the official website of Jan Dhan Yojana (https://www.pmjdy.gov.in/).

Now select one option from the Account opening form in Hindi/Account opening form in English.

Now download the form for opening a bank account.

After this, fill in all the information in the form, attach the documents, and submit it at your nearest bank.

PC Social media