Nowadays most of the people in India have started using digital payment. But even today many people use cheques for big transactions. Many times while signing a cheque we ignore some important things and later we have to bear a huge loss.

While signing a cheque or while transacting with a cheque some precautions should be taken so that any kind of fraud does not happen or the cheque does not bounce. Because if the cheque bounces the account holder's image is spoiled and cancellation of the cheque comes under the criminal category.

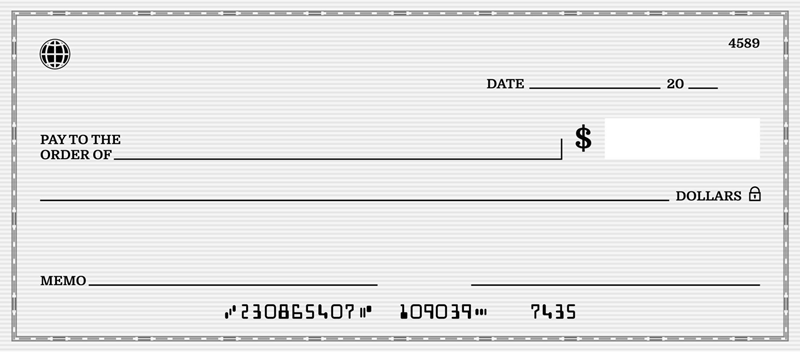

Double lines on the corners of the cheque

To keep the bank cheque safe, issue a cross cheque whenever required. By this, you can prevent it from being misused. These lines mean Account Payee i.e. the amount of the account should be received only by the person in whose name the cheque has been drawn.

Be sure to check the account balance.

While issuing a cheque, be sure to check the balance of your bank account. A cheque with an amount higher than the balance gets bounced and a penalty is levied on it. Therefore, it is very important to have sufficient balance in your account while issuing a cheque.

Do not keep a space between words.

Whenever you make a cheque payment, take care not to keep too much space between the letters while writing the name and the amount. This increases the chances of tampering with the name and the amount. Apart from this, check that the amount filled in words should be the same in numbers as well. The cheque may also get rejected if the amount does not match.

Write the correct date.

Whenever you issue a cheque, you should write the date correctly. You should never get confused about the date. If you fill in the wrong date, your cheque may bounce. Along with this, you need to correct your financial records.

Do not make mistakes while signing.

Whenever you sign a bank cheque, keep in mind that the signature should be the same as you did while opening the account. If the signature does not match then the cheque will bounce.

PC Social media