PC: Navbharat Times

The month of September has come to an end. After this, there will be some changes from October 1. Therefore, it will have a big impact on the everyday life of common people. If we do not understand these changes, there is a possibility of huge loss. So let's see what changes are going to happen from October 1. This includes the decision related to TCS, new rules of debit-credit cards, and LIC.

New rates will be applicable on TCS

New rates on Tax Collection at Source (TCS) will be applicable from October 1, 2023. If your expenditure exceeds a certain limit in a financial year, you will have to pay TCS. So whether you are traveling abroad or investing in foreign equities. A few days ago the government issued a circular in this regard. Which it was said that if expenditure exceeds the limit of Rs 7 lakh in a financial year, 20 percent of TCS will have to be paid. That means traveling abroad will become expensive for you.

New rule of debit-credit card:

RBI has provided the facility to choose the network for debit cards, credit cards, or prepaid cards. When you apply for a debit or credit card, the bank is choosing a card network. From October 1, 2023, the bank will allow its customers to choose their preferred network.

PC: tv9marathi

IDBI Bank's new scheme

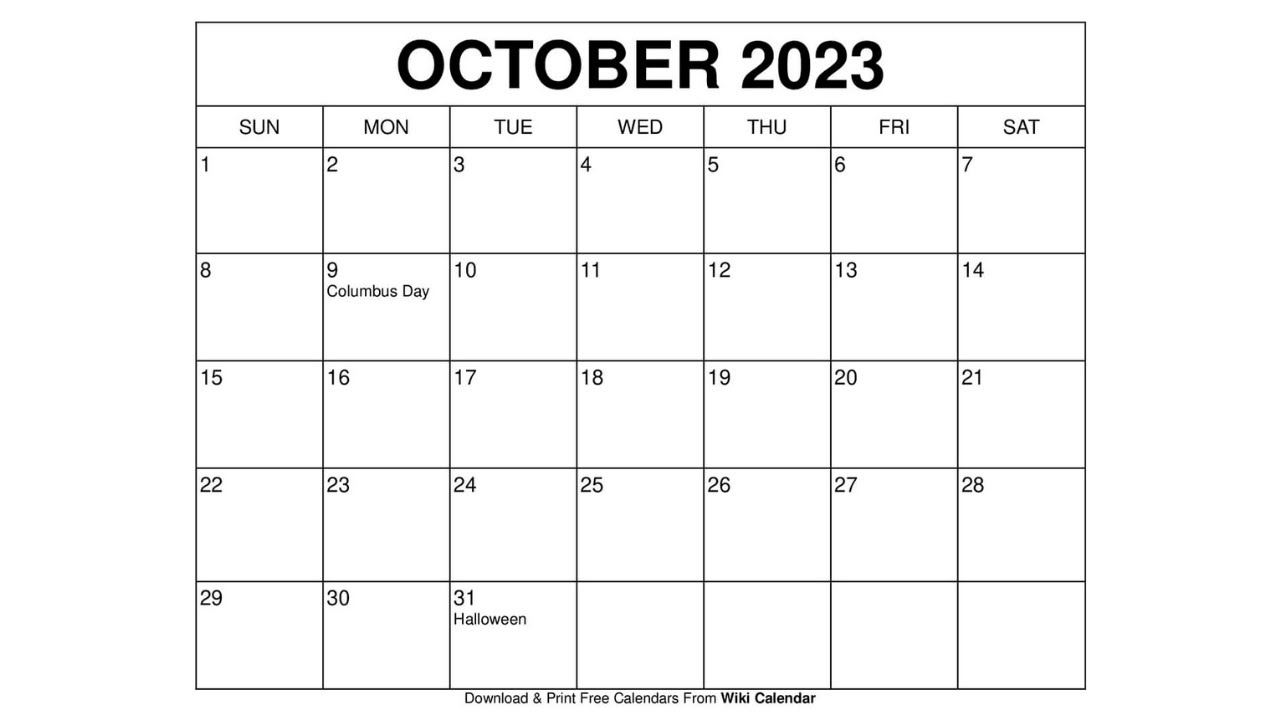

IDBI Bank has launched a new FD scheme. Their name is Amrit Mahotsav FD. This plan is for 375 and 444 days. The last date to invest in this is 31 October 2023.

Life Insurance Corporation (LIC) has given a golden opportunity to activate the closed

policy. These closed policies can be started till 31 October 2023.

PC:India.Com

2000 rupee notes will be banned.

If you still have 2000 rupee notes, then the date for depositing or exchanging them in the bank is 30th September. RBI had said in May itself that Rs 2000 notes would be phased out of circulation. Apart from this, there may be a change in the price of CNG-PNG. Besides, the price of LPG gas cylinders may also increase.