Form 16: Form 16 is an essential document to file an income tax return. Form 16 is used to submit ITR. Employed people need Form 16 to file ITR.

Companies are required to issue Form 16 to their employees by 15th June of the assessment year for which the Income Tax Return is being filed. Form 16 for the financial year 2023-24 (assessment year 2024-25) should be issued by June 15, 2024.

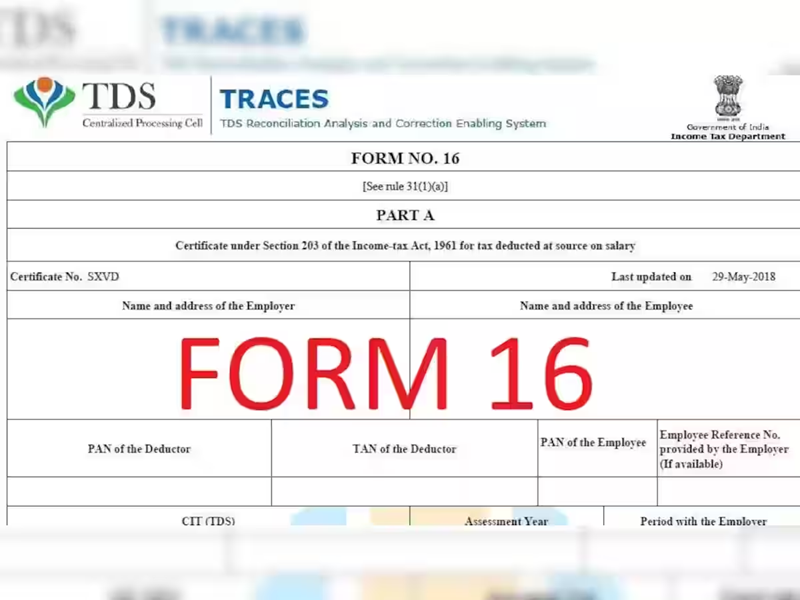

What is Form 16?

Form 16 is a certificate issued under Section 203 of the Income Tax Act 1961. It gives information about the salary earned by an employee and the taxes deducted from his salary by the employer (company). Form 16 determines whether the employer i.e. your company has deposited TDS. Form 16 is a certificate that contains all this information.

Earned income of an employee

Allowance

deduction

Tax paid by the employee-

The Form 16 Income Return (ITR) file provides information about TDS and other information about your income. Form 16 is required to file an income tax return. This helps you accurately report your income and deductions. Income tax also helps in claiming tax refunds.

What is Part A of Form 16?

Part A of Form 16 contains information about TDS deducted in each quarter.

Form 16A

Name and address of the employee

Company name and address

PAN of employee

PAN number of the company

Employer's Tax Deduction Account Number (TAN)

Form 16 Part B-

basic salary

house rent allowance

transport allowance

deduction

Contains information about exemptions taken under 80C.

Information about exemptions taken under 80CCD

Health insurance premium under section 80D

Exemption under section 80E

Exemption under section 80G

Cess and surcharge information

Download Form 16 online-

Step 1: Visit the website of the Income Tax Department- https://www.incometaxindia.gov.in/Pages/default.aspx

Step 2: Go to Form Download.

Step 3: Click on the Income Tax Form tab.

Step 4: Select Form 16 in Frequently Used Forms. Choose Option

Step 5: Select the financial year for which Form 16 is required.

Step 6: Select the PDF option under Form 16. The form will be downloaded in the next window.

PC Social media