Whenever you need a loan, the lender first asks for your CIBIL score. In such a situation, if your CIBIL score is low then you may face difficulty in getting a loan or you are given the option of loan at a higher interest rate.

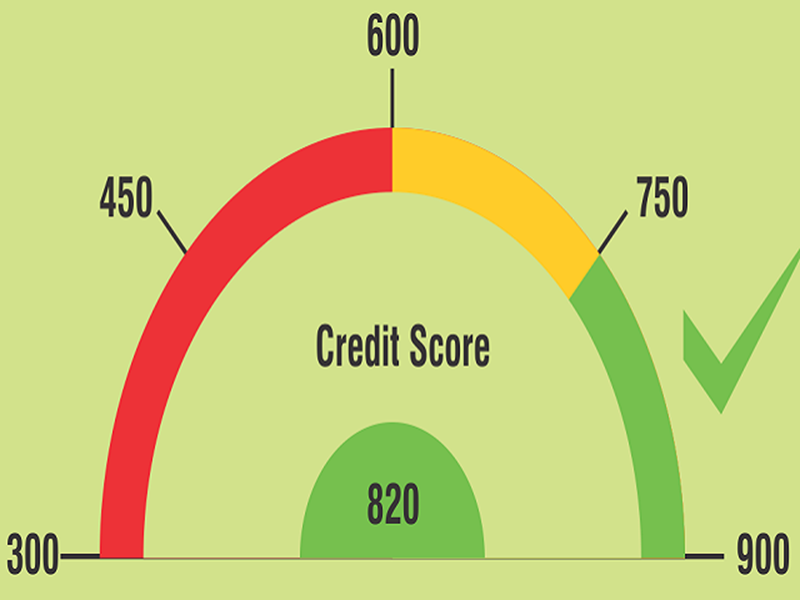

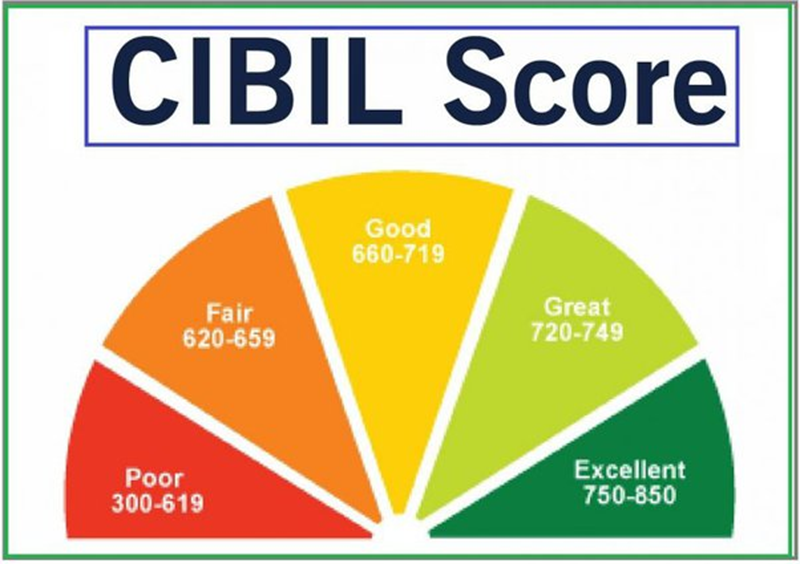

CIBIL score ranges between 300-900, with a credit score above 750 helping to get your credit card or loan application approved. If your CIBIL score is 650 or less, your chances of getting a new loan are slim. In such a situation, let us know today what are the reasons for the low CIBIL score.

1. Having a high credit utilization ratio

Credit Utilization Ratio (CUR) is the percentage of total credit utilized to the total available credit limit across all credit products. You should maintain a CUR of less than 30 percent. In simple language, you should use only 30 percent of your credit limit. Suppose your credit limit is Rs 1 lakh, then you should use only Rs 30,000 out of it.

2. Having a bad credit mix

If you have previously taken various types of loans like home loans, personal loans, and other loans then your CIBIL score is good as it shows your ability to handle your different types of credit responsibly.

But if you do not have a healthy mix of different credit products (unsecured or secured loans), your CIBIL score may go down a bit, although this does not have much impact on the CIBIL score.

3. Delay in paying bills

This plays the biggest role in reducing the CIBIL score. If you do not pay your credit card bill on time, your CIBIL score goes down very fast. However, if you forget to make bill payments once, it does not make much difference to your CIBIL score, but if you do so again and again, your CIBIL falls into the bad category.

4. Applying for multiple credits at once

If you apply for new loans and credit cards from many lenders in a short period, your CIBIL is asked the same number of times, which affects your credit score because all the information applied by you is recorded in the CIBIL report Ultimately your CIBIL score reduces.

5. Errors in CIBIL report

Errors in CIBIL reports such as incorrect account details, duplicate accounts, incorrect loan balance, errors in outstanding balance, errors in active loans/credits reported, etc. can adversely affect your CIBIL score.

You should check your CIBIL report from time to time and if there is any mistake, correct it as soon as possible.