Before using a cheque, you should have complete knowledge of its rules. Rules related to cheque book are important for every account holder. If you do not have correct information then you can become a victim of some big fraud. In such a situation, where to sign? Under what circumstances is a signed cheque to be given to someone? It becomes very important to know this. Let us try to understand today whether there will be financial risk in such a situation if you sign the back of the cheque and give it to someone. If it happens, how big will be the risk, and what are the ways to avoid it?

Keep this in mind while signing the back of a cheque.

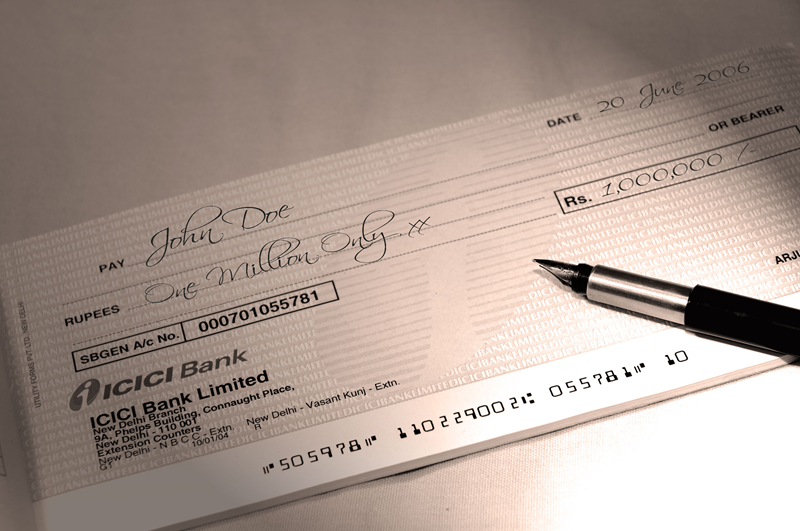

A cheque is a written guarantee of a financial institution or individual withdrawing cash. It can be understood that it is usually a written order to a bank to pay a fixed amount from one account to another. A cheque is considered by the bank as a safe, secure, and convenient way of conducting transactions between two parties. Signing on or behind a cheque has a special meaning in the language of the bank. Not all types of checks are signed on the back. Only the bearer's cheques are signed on the reverse side. A bearer's cheque is a type of check which is deposited in the bank and does not bear the name of any person. With the help of that cheque, anyone can withdraw cash from the bank. The bank treats the bearer's cheque as a transaction issued with consent. According to the rules, the bank is not responsible for fraud caused by such cheques.

-Some important things related to cheque

-Cheques can be issued for current or savings accounts.

-Only the payee named on the cheque can encash it.

-A cheque without a date is considered invalid.

-A bank check is valid for three months from the date of issue.

-There is a 9-digit MICR code at the bottom of the cheque which facilitates the cheque clearance process.

-The amount of the cheque should be written in both words and figures.

The drawer of the cheque must sign the check without overwriting.

-The name of the recipient should be written correctly on the cheque. important things

-Cheques can be issued for current or savings accounts.

-Only the payee named on the cheque can encash it.

-A cheque without date is considered invalid.

-A bank cheque is valid for three months from the date of issue.

-There is a 9 digit MICR code at the bottom of the check which facilitates the cheque clearance process.

-The amount of the cheque should be written in both words and figures.

-The issuer of the cheque should sign the cheque without overwriting.

-The name of the recipient should be written correctly on the cheque.

PC Social media